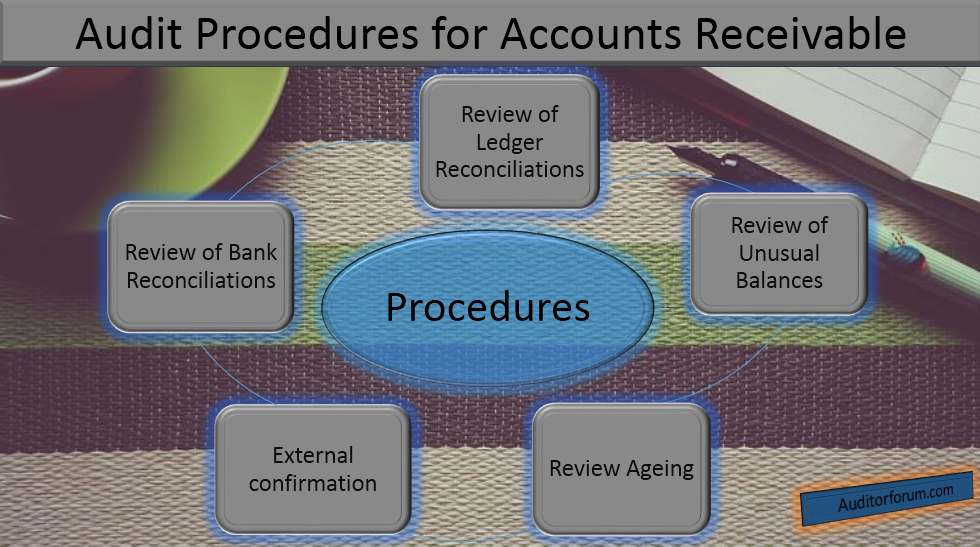

What are the audit procedures for accounts receivable?

Substantive audit procedures for accounts receivable are as follow:

audit procedures for accounts receivable

Investigate any unexpected or unusual movement/differences between current and prior period as regards the amounts of trade debts, debtor’s turnover, ageing of receivable and ratio of debtors to credit sale etc.

1. Review of period end reconciliation of subsidiary and general ledger and investigate large and unusual items.

2.Reviewing the period-end bank reconciliation statements with specific reference to the list of cheques deposited but not credited in the bank.

3.Review the following:

- Large or unusual postings in the general ledger.

- Large or unusual balances in subsidiary records including, credit balances, past due balances and balances exceeding credit limits etc.

4. Circularization of confirmations and performance of appropriate follow-up of selected customer balances at the period end and obtaining and testing reconciliation of balances confirmed with the book balance.

5. Review the ageing schedule and ensure reasonableness of provision based

- Discussion with the credit manager.

- Examination of the subsequent collections made.

- Past practice and consistency.

What are the audit procedures for store and spares?

Audit substantive procedures for store and spares:

- Obtain the listing of stores and spares balances at period-end and investigate large or unusual quantities or amounts.

- Review large or unusual entries in the ledger account.

- Review period end reconciliation of subsidiary and general ledger and investigate large and unusual items.

- Attend inventory counts at period end and ensure that physical differences are appropriately recorded and resolved and damaged items if any are identified.

- Check valuation of selected items using one or more of the recommended sampling techniques.

- Identify slow moving items and discuss/determine the impact thereof.

Audit Forum provides best question and answers practice for visitors. Share audit procedures for accounts receivable with your fellows and provide us feedback in comments. For more updates keep visiting auditorforum.com.