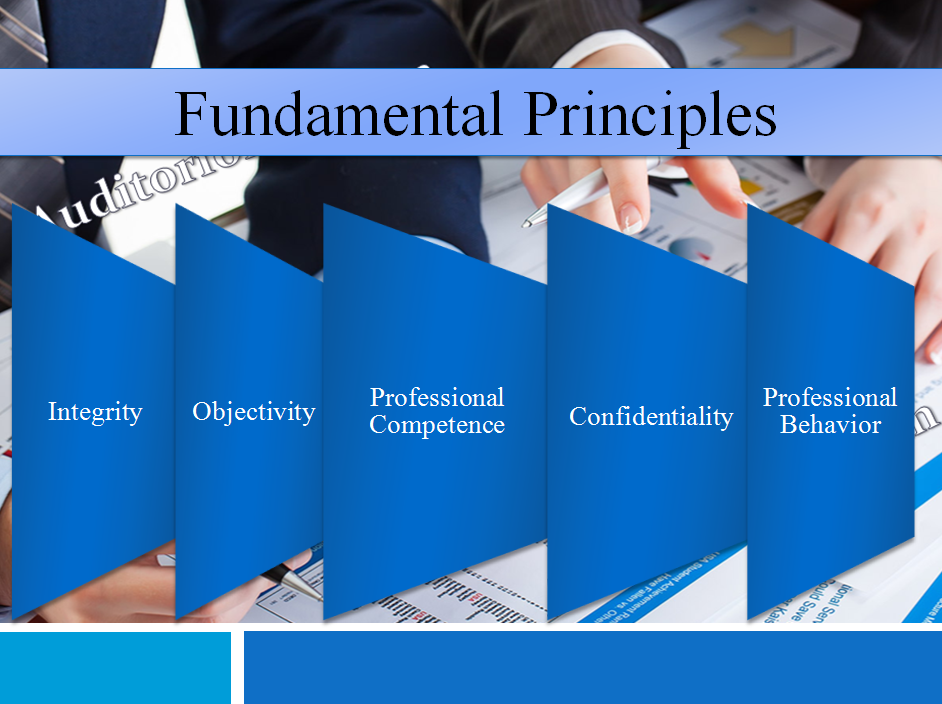

Fundamental Principles for Chartered Accountants

Integrity: Members should be straightforward and honest in all professional and business relationships. Integrity implies not just honesty but also fair dealing and truthfulness. A chartered accountant should not be associated with reports, returns, communications or other information which according to him is materially false or misleading.

Objectivity: Member should not allow bias, conflict of interest or undue influence of others to compromise their professional or business judgement.They should follow the objectivity principle.

Professional Competence and due care: Members has a duty to maintain and update professional knowledge so that client may receive competent services. they should also perform their duties with due care and diligence.

Confidentiality: Member should respect the confidentiality of information of client received in business relation with them. They should not disclose any such information to third parties without proper authority or unless they are bound by law to disclose the information.

Professional Behavior: Members should behave professionally in all their business and professional relationships. They should not do any acts which may bring discredit to the profession and should behave ethically.

Q. The principle of confidentiality imposes an obligation on chartered accountants to refrain from disclosing confidential information. State three key exceptions to the above rule.

Ans. The following are circumstances where chartered accountants are or may be required to disclose confidential information:

1. Disclosure is permitted by law and is authorized by the client. 2. Disclosure is required by law. 3. There is a professional duty or right to disclose, when not prohibited by law.

Q. Briefly state the difference between ‘actual independence’ and ‘perceived independence.

Actual Independence: Actual independence means that the auditor should not be influenced by anything which results in compromising his professional judgement while expressing an opinion.

Perceived independence: The auditor must be seen to be independent, i.e. the auditor should avoid facts and circumstances due to which a third party may conclude that his integrity, objectivity or professional skepticism had been compromised.

For more practicing questions and answers related to threats and safeguards in real life situations explore auditorforum. We are keen to know your views in comments.