Internal Audit vs External Audit

List the important differences between internal audit and external audit with respect to the following: (i) Independence (ii) Objectives (iii) Reporting

Important differences between Internal Audit and External Audit

Since internal audit is a part of the entity, no matter how autonomous and objective it is., it cannot reach the level of independence enjoyed by the external auditors.

Objectives:

The objectives of internal audit function vary according to management’s requirements. Whereas, the primary objective of external auditor is to ascertain whether or not the financial statements are free of material misstatements.

Report:

Report of external auditor is addressed to the members (shareholders) / owners / those charged with the governance of the entity.Internal audit reports are addressed to the management and those charged with the governance.

Reporting Requirements:

Reporting Requirements:

The reporting requirement of the external auditor is determined by the framework under which the audit is being carried out and by applicable legal and regulatory requirements.Reporting requirement of internal audit is based on the objectives/scope of work determined by the management and those charged with governance.

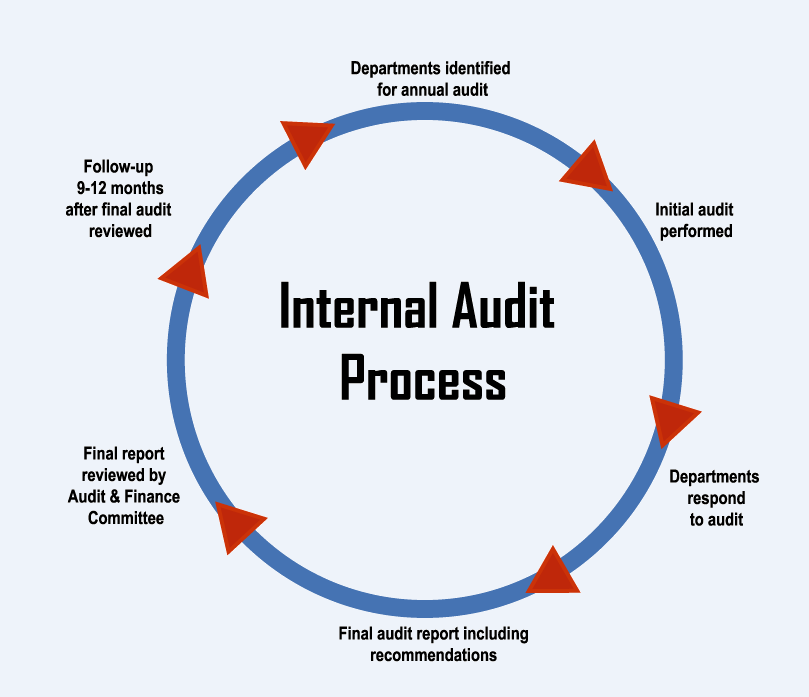

Work of internal audit

During the audit of PQR Limited you have been assigned the task of evaluating the work performed by the internal audit department of the company on certain specific areas.

Required:(a) Describe how would you evaluate the work performed, in order to determine the extent of reliance that may be placed thereon

For the purpose of determining the extent of reliance that may be placed on the work of internal auditor in specified areas, it may be evaluated by:

(i) Inspecting the adequacy of the scope of the work and related programs.

(ii) Determining by means of inspection whether the preliminary assessment of Internal audit function remains appropriate.

(iii) Obtain evidence that:

- The work is performed by staff having adequate technical training and proficiency as internal auditors and the work of assistants are properly supervised, reviewed and documented.

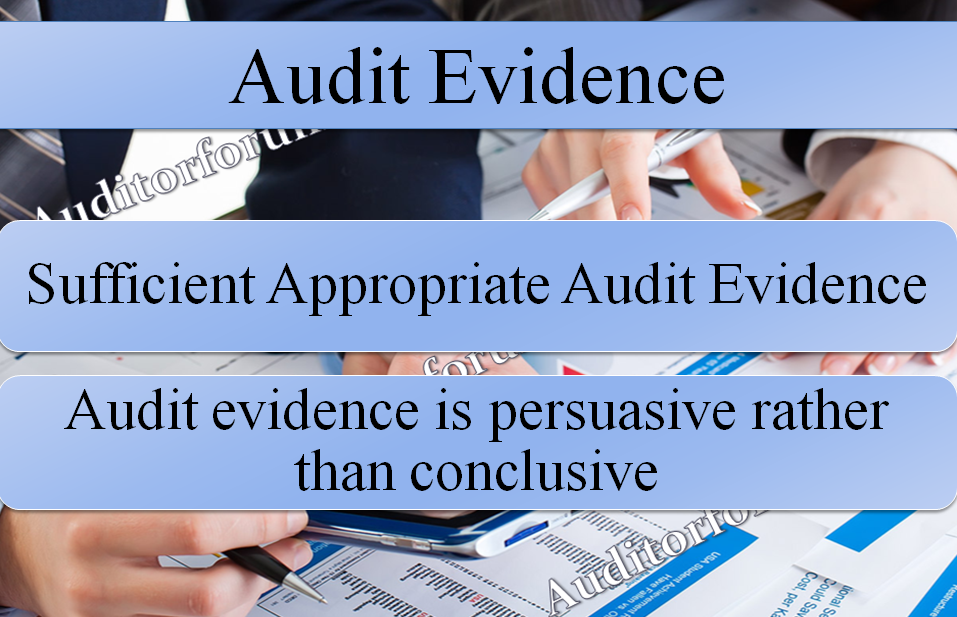

- Sufficient appropriate audit evidence was obtained to serve as a reasonable basis for conclusions reached.

- Conclusions reached are appropriate in the circumstances and any reports prepared are consistent with the results of work performed.

- Any exceptions/unusual matters disclosed by internal audit are properly resolved.

For more practicing questions and answers related to Professional judgment and skepticism in real life situations explore auditorforum.com We are keen to know your views in comments.