Definition of Money

Traditional approach: According to the traditional approach, money is regarded only as a medium of exchange. This definition emphasizes on the liquidity aspect and is expressed as M = C+D (M includes currency and D stands for demand deposits).

Monetarist approach: According to the monetarist approach, money is a temporary abode of purchasing power. It includes currency (C), demand deposits (D) and time deposits (T) i.e. M = C+D+T.

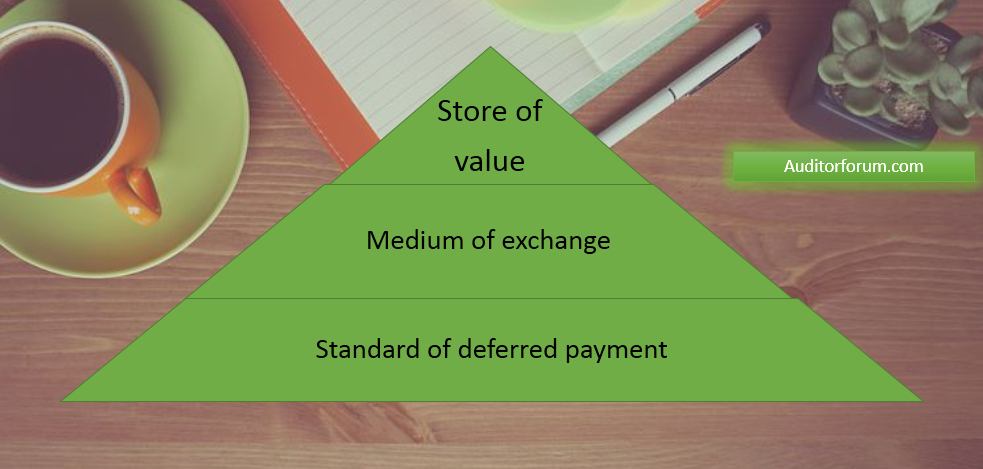

Functions of money:

These are three functions of money:

Medium of exchange:It removes the inconvenience of a barter system. The man with the cow, who wants to purchase a horse, need not search for a horse-seller, who wants a cow. He can sell his cow in the market for money and then purchase a horse thus obtained.It is used to compare value of goods and services which are dissimilar and entirely different from each other.

Standard of deferred payment:The value of money usually remains stable over a period of time. Hence it serves as a standard for the purpose of lending and borrowing.

Store of value:Money can easily be stored in large quantities. Any other commodity will usually require large space and will be subject to deterioration.

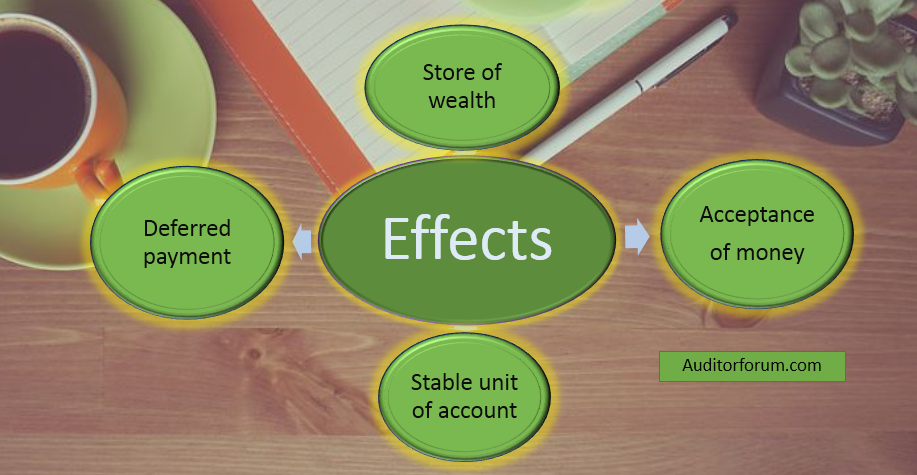

Effects of inflation on the functions of money:

These are the effects of inflation on the function of money which are given below:

1. It should be a store of wealth: In a period of inflation, although money retains its nominal value, it loses some of its purchasing power or real value. If people are concerned about money’s loss of value, they will prefer to store their wealth in different assets (e.g. gold, paintings, property or interest-bearing investments) which they do not expect to lose value.

2. It should be a standard for deferred payment: In a period of inflation when the value of money is falling over time, sellers will be reluctant to offer credit or to agree the price for future contracts. Money would then be failing to fulfill its function as a standard for deferred payment.

3. It should be a stable unit of account: As a result of inflation, the relative value of money declines and therefore it loses its function as a stable unit of account.

4. It should be an acceptable means of exchange. When inflation is very high, people might refuse to accept money in exchange. They might instead demand other alternatives such as gold or a foreign currency.

Auditorforum.com provides multiple question and answers and case study on different topics. Keep visiting auditorforum.com for more knowledge about the topics.