What are Subsequent Events?

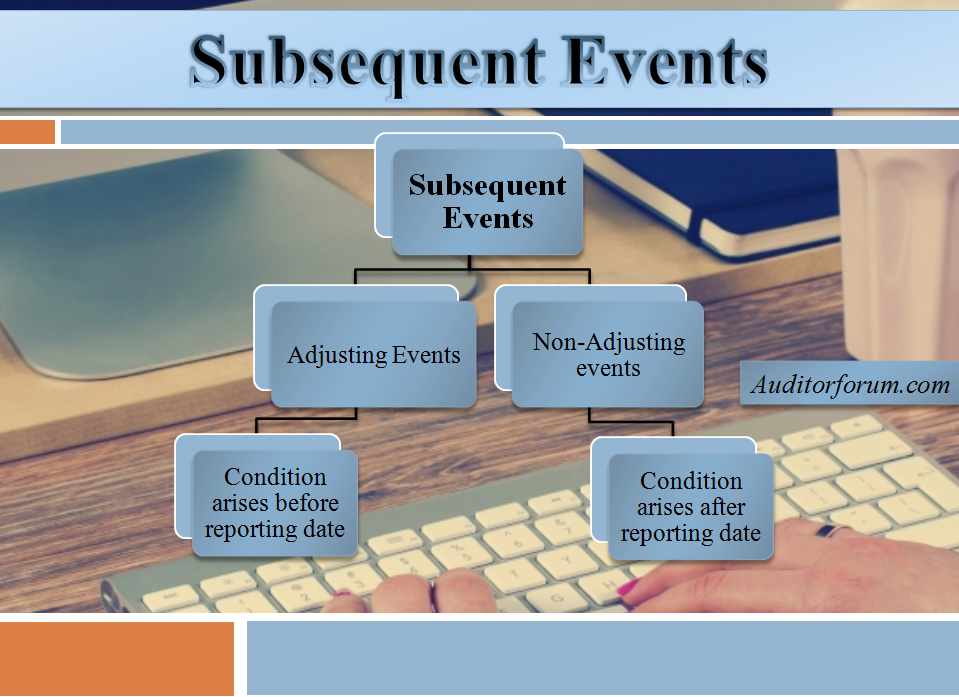

Definition: Events favorable or unfavorable occurred between the end of the reporting period and the date when financial statements are authorized for issue are called Subsequent Events.

Definition: Events favorable or unfavorable occurred between the end of the reporting period and the date when financial statements are authorized for issue are called Subsequent Events.

Types of Subsequent Events :

Adjusting Events: Subsequent Events which provide evidence of conditions that already existed at the end of the reporting period.

Non-Adjusting Events: Subsequent Events which occurred due to the conditions arising after the reporting period.

Audit Procedures in identifying Subsequent Events that require either adjustment or disclosure in the financial statements.

List the audit procedures that may be performed by the auditor in order to ensure that all events occurring between the date of the financial statements and the date of the auditor’s report that require adjustment of, or disclosure in, the financial statements are identified and appropriately reflected in the financial statements.

Audit Procedure – Subsequent Events

The following procedures will help the auditor in identifying Subsequent Events that require either adjustment or disclosure in the financial statements.

- Review existing procedures (if any) laid down by the management to identify these events.

- Study minutes of the meetings of the Members, Board of the directors and other important executive committees (if any) held after the balance sheet date and enquire about the matters which may be relevant in this regard.

- Discuss with key officials on matters such as company’s policy on marketing of new products, price structure, major sales order booked or cancellation of sales orders and loss of major customers, if any, new borrowings, capital commitments, fresh guarantees, outcome of pending law suits and any change in accounting policies etc.

- Ascertain the status of litigations, claims etc. against the company from its legal advisors.

- Inquire, or extend previous oral or written inquiries, of the entity’s legal counsel concerning litigation and claims

- Read the entity’s latest available budgets, cash flow forecasts and other related management reports for periods after the date of the financial statements.

- Obtain written representation from the management that all relevant events have been appropriately accounted for/dealt with.

- Obtain an assurance from management about the :

- Current status of items that were accounted for on the basis of estimates or inconclusive data.

- Any events occurred or likely to occur which will require change in the existing accounting policies.

- Any events which may cast doubts about the validity of entities ‘going concern’ assumption. For this purpose, the auditor should remain alert for the circumstances which may cast significant doubt on the company’s ability to continue as a going concern.

Auditorforum.com is looking forward for your feedback and keen to know your point of view and queries about any post in comments. For more information keep on exploring Auditor forum.