Audit Evidence

The outcome of an audit is a report, usually expressing an opinion.That report and opinion must be supportable by the auditor, if challenged.Therefore, the auditor will collect evidence on which to base his report and opinion. These evidences are called Audit Evidences. The auditor carries out procedures known as ‘audit tests’ in order to generate this evidence.These tests, the evidence and the conclusions drawn must be documented.

Auditor forum has already discussed Audit Evidence and Sufficient appropriate audit evidence through Sufficient Appropriate Audit Evidence and related Question and Answers.

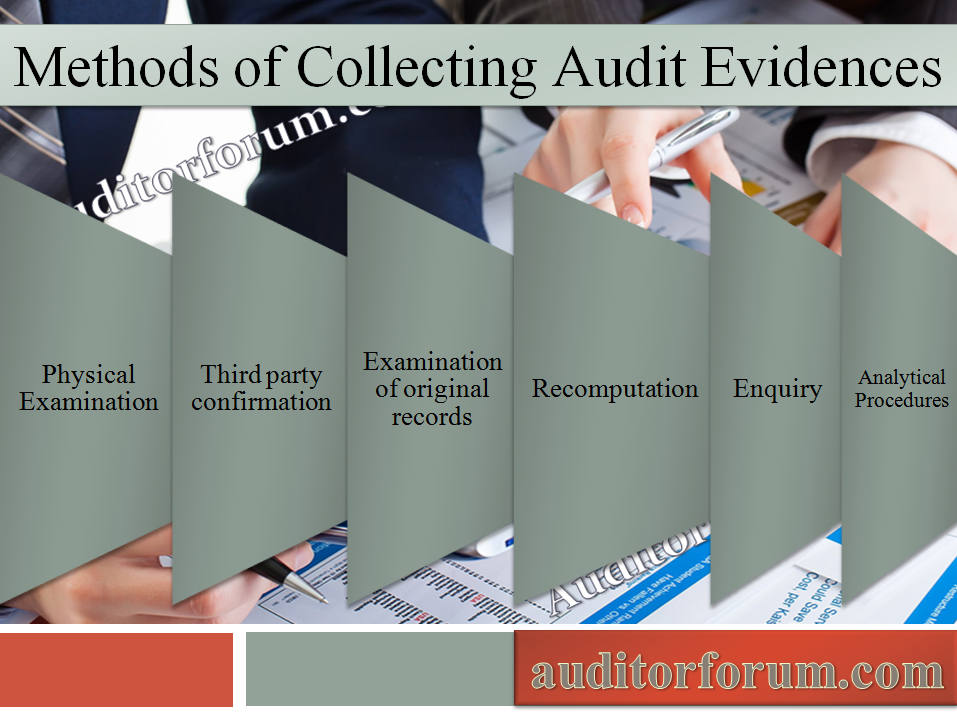

Methods of Collecting Audit Evidence

Physical Examination: Physical examination means physical verification of an asset, such as stocks, investment certificates and fixed assets, as an evidence of its existence and its condition.

Third party confirmation: Confirmation of an amount or other information shown in the client’s records by an independent third party provides a reliable evidence of the existence of the amount and correctness of the information, as the case may be. For example, receivables, payable, contingent liabilities, stock with third parties etc.

Examination of original records: Original records like ownership documents, bills, notices etc. provide a reliable and conclusive evidence of the legal claims, transactions, balances etc.

Re-computation: Re computation technique is applied to prove arithmetical accuracy of a transaction and to verify that the computation is in accordance with the rules, procedures and acceptable practices. The areas where re-computation techniques are generally applied include depreciation computations, bonus calculations, provisions etc.

Enquiry: Enquiry consists of seeking information from knowledgeable persons, both financial and non-financial, within the entity or outside the entity. The enquiry may not provide conclusive audit evidence but it may give some form of clue which may lead to further verification.

Analytical Procedures: Analytical procedures consist of evaluations of financial information through analysis of plausible relationships among financial as well as non-financial data. Analytical procedures also encompass investigation of identified fluctuations or relationships that are inconsistent with other relevant information or that differ from expected values by a significant amount.

For more information about this topic keep exploring auditorforum.com. We are keen to know your feedback in comments.