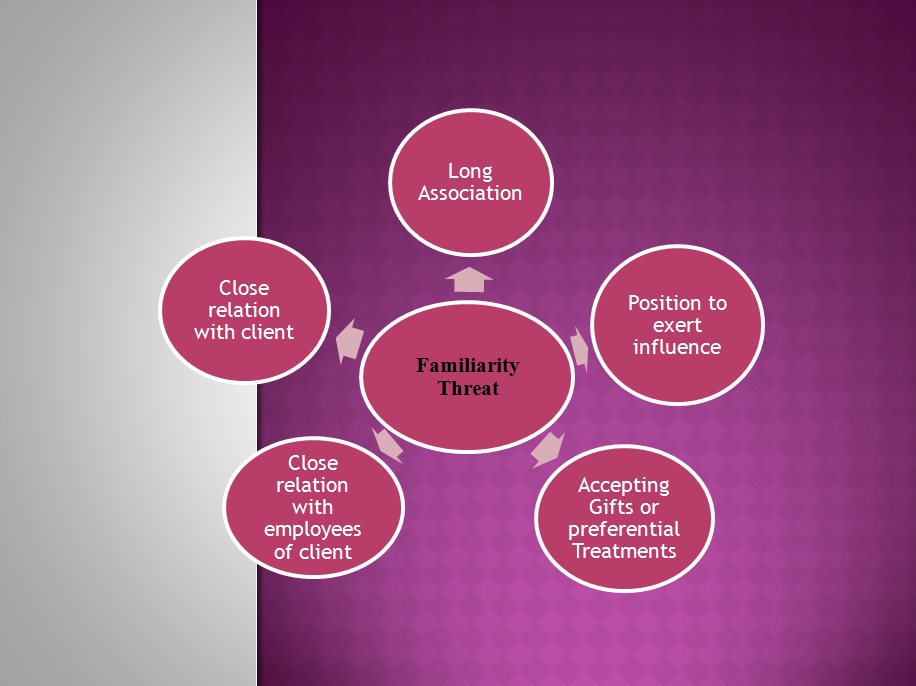

Familiarity threats: This may occur when, because of a close relationship, a chartered accountant becomes too sympathetic to the interests of others.

- A member of the engagement team having a close or immediate family relationship with a director or officer of the client

- A member of the engagement team having a close or immediate family relationship with an employee of the client who is in a position to exert direct and significant influence over the subject matter of the engagement

- A former partner of the firm being a director or officer of the client or an employee in a position to exert direct and significant influence over the subject matter of the engagement

- Accepting gifts or preferential treatment from a client unless the value is clearly insignificant

- Long association of senior personnel with the assurance client

Identify category of threat involved in each independent situation as Familiarity threat, Advocacy or Intimidation Threat. Also suggest some safeguards to minimize their effects.

Q.Mr.A was the audit manager during the last year’s annual audit of (FTML). He has joined FTML as their Manager Finance, prior to the commencement of the current year’s audit.

Ans.Threats: It has created self interest, familiarity and intimidation threats. The assurance team’s independence is threatened, on account of the fact that Mr.A is in a position to exert direct and significant influence over the assurance engagement as Mr.A was a member of the assurance team during the previous year audit.

Safeguards: The safeguards might include:

Consider the appropriateness or necessity of modifying the assurance plan for the assurance engagement;

- Assigning an assurance team that is of sufficient experience in relation to the individual who has joined the assurance client;

- Involve an additional chartered accountant who was not a member of the assurance team to review the work or advise as necessary; or

- Quality control review of the assurance engagement

- Ensuring that the individual concerned is not entitled to any benefits or payments from the firm unless these are made in accordance with fixed pre-determined arrangements. In addition, any amount owed to the individual should not be of such significance to threaten the firm’s independence.

- Ensuring that the individual does not continue to participate or appear to participate in the firm’s business or professional activities.

Q.Mr.D is employed in a firm of Chartered Accountants. He has been a member of the audit team of (ML) for the last few years.

Ans.Using the same senior personnel on an assurance engagement over a long period of time may create a familiarity threat. The significance of threat will depend upon factors such as:

- The length of time Mr.D has been a member of the audit team;

- The role of Mr.D in the audit team; and

- The structure of the firm

If the threat is clearly other than clearly insignificant, possible safeguards that can be adopted are as follows:

- Rotating the senior personnel off the assurance team;

- Independent internal quality reviews.

Auditorforum.com is looking forward for your feedback and for more on Threats click on the following links. Keep on exploring auditor forum.

Advocacy threat with examples and related safeguards

Intimidation threat with examples and related safeguards

Self Interest Threat to Auditor and related Safeguards

Self Review Threat with examples and real life situations