Discuss the categories of threats and safeguards in each of the following situations:

Your firm is the auditor of Super Markets Limited, a chain of super markets. During a promotional campaign, the management has distributed discount vouchers which have also been given to the audit team members.

Ans. Accepting of discount vouchers may create self interest and intimidation threats. However, if the value of discount vouchers is not clearly insignificant, the threat to independence cannot be reduced to an acceptable level by the application of any safeguard. If the value is other than clearly insignificant, the members of the audit team should be instructed not to accept the discount vouchers.

[wpipa id=”616″]

You are the manager on the audit of a Textile Mills Limited. The client has requested you to send two staff members on secondment for three months to assist the chief financial officer as its two senior accounting team members have resigned recently.

Ans. The lending of staff by a firm to an audit client will create a self-review threat. However, the threat may be reduced to an acceptable level if the firm’s personnel:

- are not involved in exercising discretionary authority; or

- do not assume management responsibilities.

- are not given audit responsibility for any function or activity that they performed or supervised.

The audit client should acknowledge its responsibility for directing and supervising the activities of assigned personnel.

[wpipa id=”616″]

Fine Petroleum Limited (FPL) is the audit client of your firm for five years. During the year, the engagement partner has been changed due to mandatory rotation as per Code of Corporate Governance. However, the firm has decided to retain Atif, the audit manager, who has been involved in the audit of FPL for the past five years.

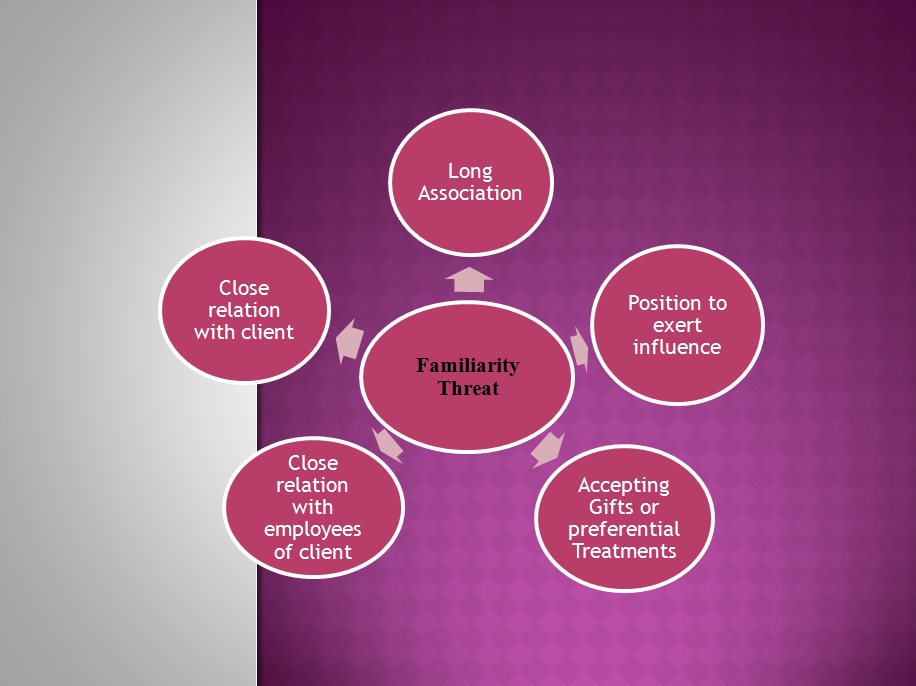

Ans. Familiarity and self-interest threats are created by using the same senior personnel on an audit engagement over a long period of time. This applies to the audit manager also. The significance of the threats shall be evaluated and following safeguards should be applied if necessary to eliminate the threats or reduce them to an acceptable level:

- Rotating the audit manager as well;

- Having a professional accountant who was not a member of the audit team

- review the work of the audit manager;

- Regular independent internal or external quality reviews of the engagement.

[wpipa id=”616″]

For more practicing questions and answers related to threats and safeguards in real life situations explore auditorforum through following links. We are keen to know your views in comments.

Advocacy threat with examples and related safeguards

Intimidation threat with examples and related safeguards

Self Interest Threat to Auditor and related Safeguards

Familiarity Threat to auditor and related Safeguards

Self Review Threat with examples and real life situations